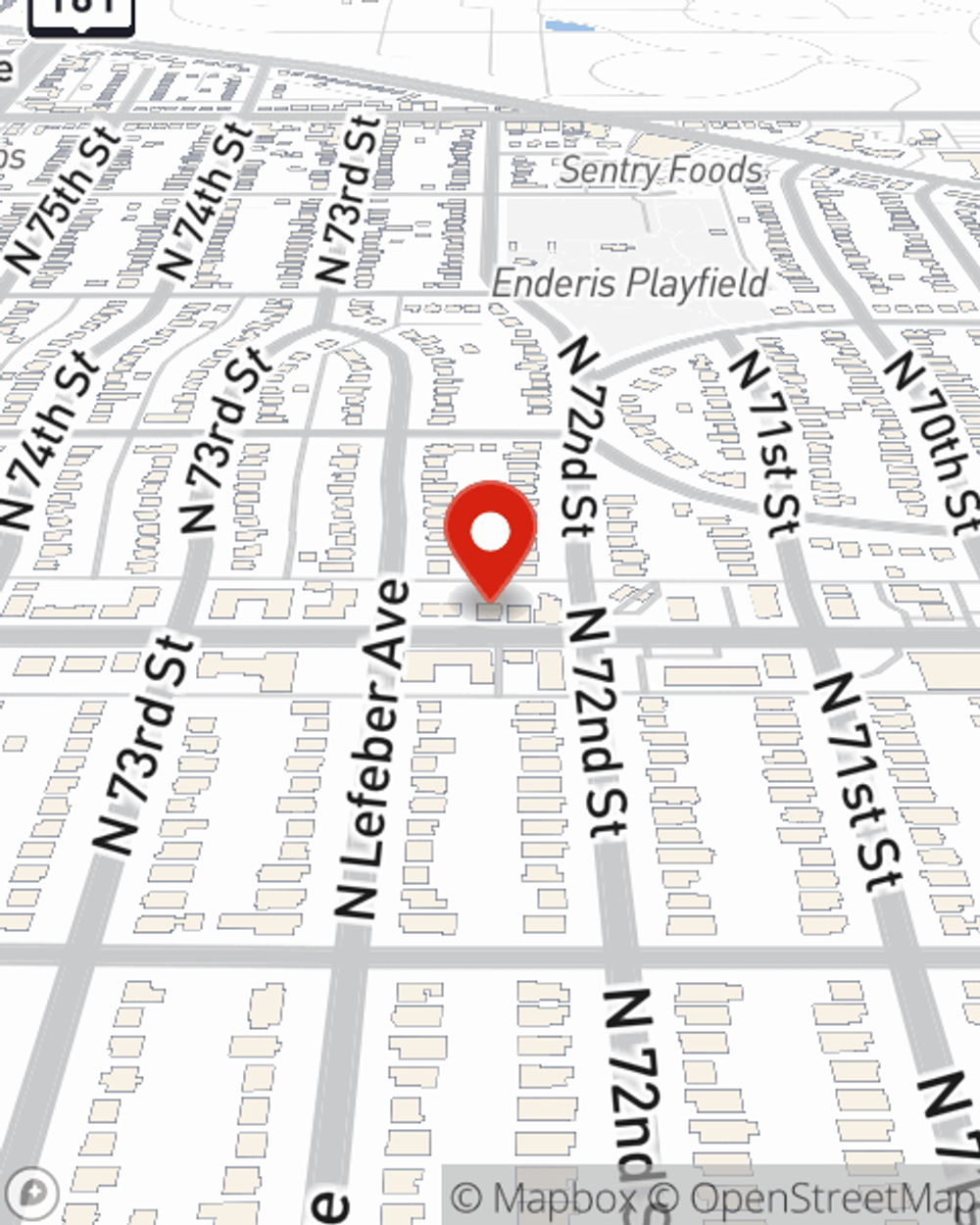

Business Insurance in and around Milwaukee

One of Milwaukee’s top choices for small business insurance.

No funny business here

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to consider. It's understandable. State Farm agent Laura Ashley is a business owner, too. Let Laura Ashley help you make sure that your business is properly insured. You won't regret it!

One of Milwaukee’s top choices for small business insurance.

No funny business here

Insurance Designed For Small Business

If you're looking for a business policy that can help cover buildings you own, accounts receivable, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

It's time to get in touch with State Farm agent Laura Ashley. You'll quickly learn why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Laura Ashley

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.